USS Investment Builder: the first year

In October 2016, USS launched USS Investment Builder, the new defined contribution section of the scheme.

One year on, we take a look at how the DC section has performed, and how our members feel about it.

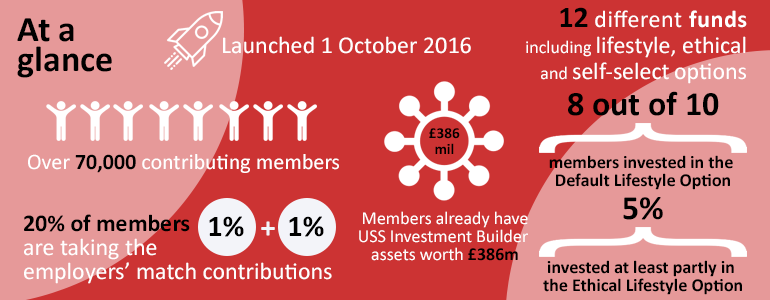

Over 70,000 contributing members are saving in the Investment Builder, either as a result of earning over the salary threshold, recently transferring into USS from another pension scheme or because they’ve chosen to make additional contributions (including the match). Over 40,000 members have voluntarily opted to save more than their regular contributions with USS, 20% of whom have taken the match. The USS Investment Builder now holds over £386m in assets, making it one of the fastest growing defined contribution schemes in the UK. Some of these assets were transferred in from the legacy Prudential Money Purchase AVC arrangement during 2017, allowing many active and deferred members to benefit from the lower charges now available in the USS Investment Builder who were previously paying higher fees to Prudential. Currently, employers further enhance the value by paying some of the charges on behalf of members.

In the first 12 months of USS Investment Builder, the USS administration team and our external administration provider processed around 850,000 transactions using 25 million data inputs.

Fund performance

The vast majority of people in USS Investment Builder are invested partly (more than 90%) or wholly (83%) in the Default Lifestyle Option – that’s the investment option your contributions are automatically invested in if you haven’t made an active investment choice. Some of those members (around 6,000) have actively chosen, through My USS, to remain invested in the Default Lifestyle Option designed by the trustee. The Default Lifestyle is a combination of three funds that range from higher risk and return to a lower risk more diversified end point. Members are automatically moved between the three funds as they approach retirement, helping to ensure their retirement savings have a growth orientation at the outset of their career and then de-risk to protect the value of their pots as they approach their target retirement date. Members should ensure that the target retirement date that they have recorded in the system is actually the date they intend to retire, so that the trustee can ensure that their assets are moving in line with this target date.

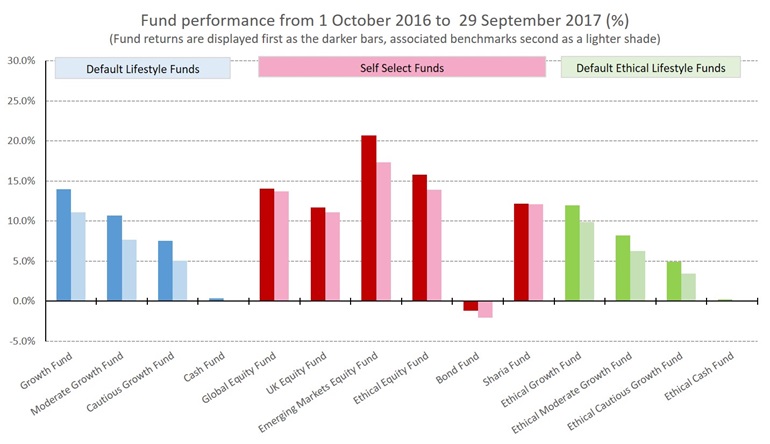

Over the first year, DC absolute returns have been significantly positive, with cash and bonds lagging other asset classes. In addition, all funds have outperformed their benchmarks. The funds in the Default Lifestyle Option have performed very well, with the USS Growth, Moderate Growth and Cautious Growth Funds all outperforming their benchmarks by at least 2%. This is mainly due to the strong performance of our active fund managers, in particular our emerging markets equity manager.

You may be aware that there is also an Ethical Lifestyle Option, which will only make investments that meet the USS Ethical Guidelines developed specifically for USS members. Around 5% of members (that’s over 3,500 people) have selected this option, either alone or in combination with other options. The funds in the Ethical Lifestyle Option have also performed well over their first year, all outperforming their respective benchmarks though slightly less well than similar funds with no exclusions.

We are pleased with the good start to the funds’ performance, with all funds having exceeded their benchmark in the first year. However it is important to remember that pensions are long term investments and as such we benchmark performance over longer periods (minimum five years), monitoring as we go along. Measuring the USS Investment Builder performance is simple; each fund has a benchmark which is comprised of one or multiple market indices, for example the FTSE100 index. We publish factsheets each quarter to show members how the funds have done relative to these benchmarks. Individual fund factsheets are available in My USS.

You can find actual performance of the individual funds on the fund factsheets within My USS, updated quarterly. If you’d like to see an indication of longer term performance of the funds in the USS fund range you can view the Market Performance Summary. Log in or register with My USS to view the fund factsheets.

How do our members feel about the...

...opportunity to save more?

Our surveys* show that members value the flexibility the USS Investment Builder offers, including the ability to draw their savings from age 55 (rising to 57 in 2028) independently of their USS Retirement Income pension or pass them on to their dependants (to take advantage of current tax rules in this area).

… investment options?

The vast majority of people in the USS Investment Builder are invested in the Default Lifestyle Option, either by default or by choice. 49% of people in the USS Investment Builder say they reviewed the fund choices and stayed with the default option. Around 10% of members have chosen to invest some or all of their savings in the Ethical Lifestyle Option, and a further 7% have made choices from our range of ‘Let Me Do It’ funds. A number of members have combined lifestyle options with self-select options and members are generally opting for medium-higher risk investment options for their matching and additional contributions.

It is important you review any investment choices you have made, or plan to make, in the USS Investment Builder to ensure the options that you are choosing remain appropriate for your own retirement plans. All your investment choices can be reviewed via My USS.

…website?

We’ve worked hard over the last 18 months to deliver an online experience that our members find useful. 56% of members are familiar with the website, and 59% of members familiar with our online tools rated them as good or very good. We know the USS website is the most popular source for members when they have questions about their USS benefits and improving the online experience will remain a priority for us.

*USS Action and Engagement Survey 2017

All figures shown are correct as at 29 September 2017.