Lower for Longer – the investment outlook

The investment environment in 2019 has been characterised by falling bond yields. So much so, in fact, that in many countries yields reached the lowest levels in history. A sizable proportion of the world’s government bonds are now trading in negative yield territory. Whatever happens to yields next, the low current levels of yields make a depressed return from bonds highly likely over the next decade.

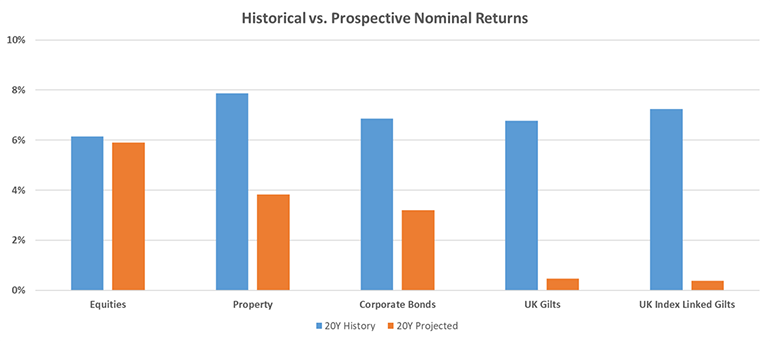

The chart below shows that, over the last two decades, virtually all asset classes delivered solid nominal returns. By contrast, our projections imply that over the next 20 years, the situation will be reversed, as nominal returns across most asset classes are expected to be low.

This difficult outlook is most pronounced for long-term UK inflation-linked bonds (see UK Index Linked Gilts bar above). This asset class is of particular relevance to a UK Defined Benefit pension scheme like USS, as it most closely resembles the pension liabilities we must pay, in terms of the certainty of payment and their linkage to future inflation. Our return expectation for these bonds stands out as abnormally low compared with most other markets because we focus on returns from the longest-term bonds (as our pension liabilities stretch far into the future), which are particularly sensitive to our projection of a small increase in yields.

Further risks to UK inflation-linked bond returns come from the uncertain future of the UK Government’s measures of inflation. Over the last decade, various attempts have been made to scrap or reform the Retail Price Index (RPI) – the index used for UK inflation-linked bonds – which has been discredited as a good measure of inflation. Yet RPI survived largely unchanged as a legacy index. In September 2019, however, the Chancellor announced that the Government would consult again on reforming the RPI from 2025, sending UK inflation-linked bonds plummeting in value.

At USS we have long been aware of this risk and so, for example, we have increased our allocation over many years to private markets. These are entities that are not listed on a stock market but offer long-term investors like pension schemes the opportunity to invest over decades for a steady return, potentially with some inflation-linkages.

Elsewhere, more recently we have looked to increase our allocation to corporate bonds and emerging market debt. For example, since 2016 we have increased our allocation to inflation-linked emerging market bonds which have been issued by governments in local currency and are indexed to local inflation – thereby earning higher yields from these faster growing economies with some inflation protection.

USSIM’s active approach to managing the scheme’s assets ensures that we remain alive to both the risks and opportunities available globally.

Mirko Cardinale

Head of Investment Strategy and Advice

USS Investment Management Ltd.